Stay ahead with real-time port delay data powered by Tradlinx

Track the full journey and access live ETAs, delay alerts, and API-ready data—all with a single, cost-efficient B/L.

Learn MoreB/L TrackingTrack shipments instantly with just your container number, from pickup to return, in app or via API.

Learn MoreContainer TrackingGet shipment visibility earlier starting with the booking number you already have, enabled by API integration.

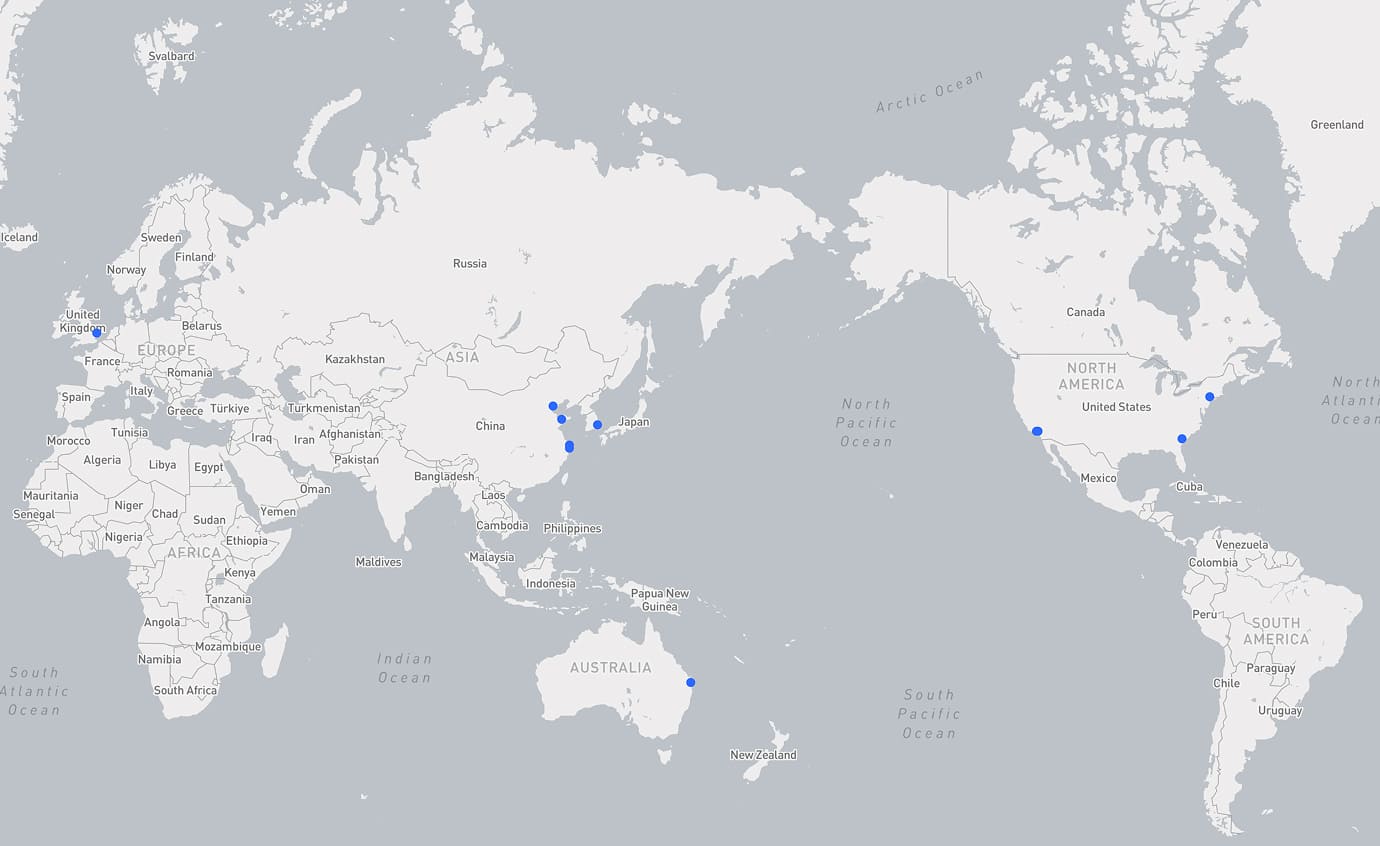

Learn MoreBooking No. TrackingTrack vessel locations, routes, and delays in real time before, during, and after port calls, available by API or dashboard.

Learn MoreVessel TrackingLoading feed...

Port disruption rarely starts with headlines. It shows up first as measurable friction—longer berth waits, rising container dwell, and slower gate turn times. Here’s how to read those port metrics as early signals, and what actions planning teams can take before delays cascade.

Winter disruptions become expensive when containers can’t evacuate inland reliably—rail slots slip, truck cycle times inflate, and gate controls tighten. This Q1 readiness checklist shows how to triage containers by exposure, set trigger rules for tactical switches, and capture evidence early to reduce dwell, missed cut-offs, and avoidable cost.

Everyone wants faster transit, but not every warehouse is ready for it. When a loop moves from Cape to Suez, cargo can land one to two weeks earlier than planned. This post explains how that can overwhelm European DCs and what LSPs can do to smooth the shock.

Northern Europe’s winter disruption is now primarily an inland evacuation problem—rail reliability, truck appointment scarcity, and constrained river/bridge movements—rather than only terminal productivity. This alert outlines current risk patterns, practical action steps for the next 3–5 business days, and the signals that indicate improvement or further deterioration.