Cut costs, maximize efficiency, seamlessly manage your supply chain with precision data.

“TRADLINX helped us reduce our shipment management time from hours to under a minute per B/L.

This real-time visibility has allowed us to respond faster to any changes,

improving our logistics efficiency and ensuring our customers receive timely updates.”

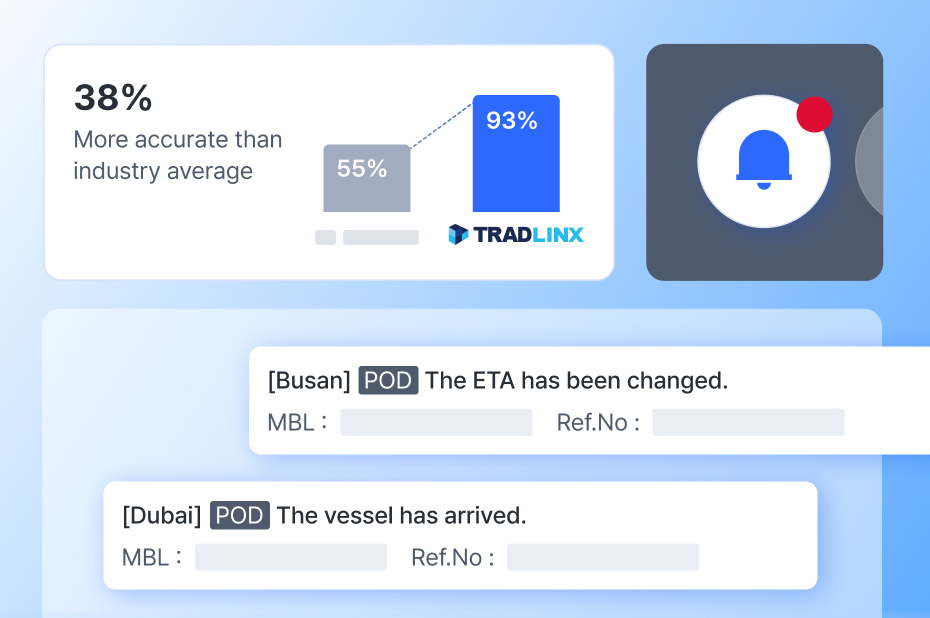

“For over 5 years, TRADLINX has supported us in delivering 99% data accuracy and hourly updates for Samsung’s Galaxy mobile device shipments. The branded portals and automated notifications have significantly reduced manual work, helping us ensure smooth global operations for Samsung.”

“Using TRADLINX’s real-time performance metrics and predictive timelines, we’ve improved our decision-making and efficiency. The data insights have allowed us to prevent delays and better manage carrier performance, ensuring smooth and cost-effective operations.”

From internal operations to customer experience, TRADLINX streamlines logistics across the board.

Cut manual processes by 50%, elevate partner collaboration, and deliver the real-time insights that keep your customers loyal.

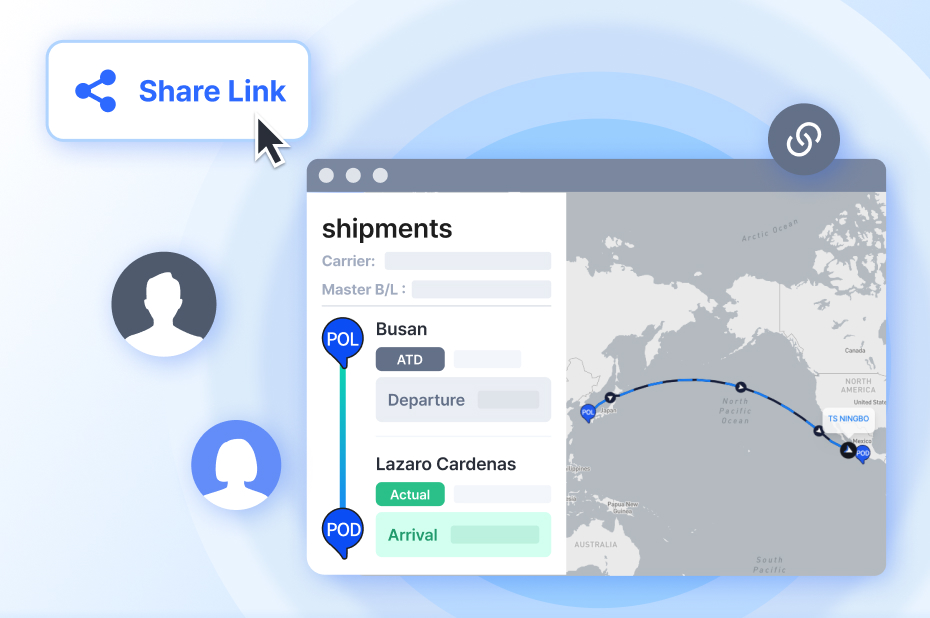

Delays erode customer trust and directly impact your bottom line. With TRADLINX’s 24/7 tracking,

you eliminate uncertainty, keep operations on track, and retain loyal customers.

Loading feed...

Port conditions this week are being shaped by yard density and terminal-level divergence: Rotterdam (MVII) is near full, Ningbo (MSICT) exceeds 90%, and several secondary hubs show multi-day waits. This briefing prioritizes where LSPs face the highest operational risk—and what to do now.

Q1 tenders can feel like a pricing exercise. For forwarders, they’re often a risk-allocation exercise. This checklist is a practical way to avoid “winning” contracts that quietly guarantee margin leakage, exceptions work, and service disputes for the rest of the year.

With 541 new bulk carriers entering the market, shifting freight rates, and emerging trade routes like Simandou-China, 2025 is set to reshape dry bulk shipping. Discover key trends and strategic actions for logistics service providers to stay ahead.

A telex release accelerates cargo pickup when original documents are delayed, but it’s not always available—and it carries real liability. Learn when telex release works, what carriers charge, why negotiable BLs are off-limits, and the critical controls you need in place before requesting one.